Use VCE Exam Simulator to open VCE files

Get 100% Latest Microsoft Certified: Dynamics 365 Supply Chain Management Functional Consultant Associate Practice Tests Questions, Accurate & Verified Answers!

30 Days Free Updates, Instant Download!

MB-330 Premium Bundle

Microsoft Certified: Dynamics 365 Supply Chain Management Functional Consultant Associate Certification Practice Test Questions, Microsoft Certified: Dynamics 365 Supply Chain Management Functional Consultant Associate Exam Dumps

ExamSnap provides Microsoft Certified: Dynamics 365 Supply Chain Management Functional Consultant Associate Certification Practice Test Questions and Answers, Video Training Course, Study Guide and 100% Latest Exam Dumps to help you Pass. The Microsoft Certified: Dynamics 365 Supply Chain Management Functional Consultant Associate Certification Exam Dumps & Practice Test Questions in the VCE format are verified by IT Trainers who have more than 15 year experience in their field. Additional materials include study guide and video training course designed by the ExamSnap experts. So if you want trusted Microsoft Certified: Dynamics 365 Supply Chain Management Functional Consultant Associate Exam Dumps & Practice Test Questions, then you have come to the right place Read More.

Microsoft Dynamics 365 Supply Chain Management Functional Consultant Associate: An In-Depth Exploration

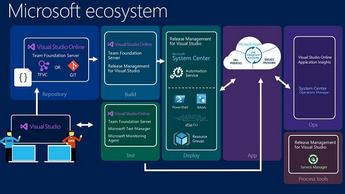

Microsoft Dynamics 365 Finance and Operations is an intricate enterprise resource planning solution, meticulously designed to integrate a multitude of business processes into a seamless framework. Organizations adopting this platform find it indispensable for optimizing workflows, enhancing operational efficiency, and obtaining granular insights into their financial and operational health. Unlike conventional ERP systems, Dynamics 365 provides a confluence of modules that converge finance, procurement, sales, and production into a unified architecture, offering a holistic view of organizational performance.

The platform’s architecture is intentionally modular, allowing businesses to implement specific functionalities that cater to their immediate operational needs while maintaining scalability for future growth. Consultants focusing on this system must not only acquire technical proficiency in configuring and implementing the modules but also cultivate a strategic mindset to understand how different elements interconnect. Mastery of Dynamics 365 requires an appreciation of both the granular mechanics of the system and the overarching strategic advantages it provides, enabling organizations to transform raw data into actionable insights and informed decision-making.

A key element of the platform is its capability to automate complex business processes, reducing the burden of repetitive tasks and minimizing human error. This is particularly valuable in financial operations, where precision and timeliness are paramount. Automated processes can include everything from order management and invoicing to multi-level approval workflows, ensuring that organizational policies are consistently applied. By leveraging automation, companies can reallocate resources from routine administrative duties to higher-value activities such as strategic planning and operational optimization.

Workflow design within Dynamics 365 requires meticulous attention to the nuances of business operations. Consultants must collaborate with stakeholders to identify bottlenecks, redundancies, and inefficiencies in existing procedures. Through careful analysis, they can configure workflows that mirror business logic, align with compliance standards, and anticipate future operational requirements. For instance, a workflow designed for invoice processing can automatically validate entries, route documents for hierarchical approvals, and trigger notifications when discrepancies occur. Such automation not only expedites processes but also enhances accountability and transparency, ensuring that every step is traceable and auditable.

The strategic deployment of Dynamics 365 Finance and Operations transcends mere operational efficiency. It facilitates the integration of disparate departmental functions, promoting interdepartmental cohesion and aligning objectives across finance, operations, and strategic planning. When financial data, inventory records, and sales forecasts converge within a single system, managers can gain unprecedented insights into resource allocation, revenue trends, and operational performance. This visibility empowers leadership to make proactive decisions, reduce costs, and seize market opportunities with agility.

Workflow automation in Dynamics 365 Finance and Operations represents a paradigmatic shift from conventional manual processes. Traditional methods often suffer from delays, inconsistencies, and susceptibility to human error. By contrast, automation provides a deterministic sequence of actions that are executed with precision and speed. Consultants configuring these workflows must possess a deep comprehension of business requirements and the technical acumen to translate those requirements into system configurations.

An automated workflow might initiate when a customer order is placed, immediately triggering a series of actions including stock verification, invoice generation, and multi-tiered approval procedures. Each action within the workflow is designed to reduce latency, prevent errors, and ensure that data flows accurately between modules. The cumulative effect is a reduction in operational friction, allowing employees to concentrate on tasks requiring analytical or creative judgment rather than repetitive intervention.

Beyond transactional efficiency, automation fosters strategic insights. Automated data collection and processing ensure that every transaction is captured consistently and comprehensively. This reliable data foundation is critical for advanced analytics, predictive modeling, and financial forecasting. Consultants leverage this capability to build reporting frameworks that illuminate organizational performance, uncover inefficiencies, and suggest areas for operational refinement. In this way, Dynamics 365 becomes both a transactional engine and a decision-support tool, facilitating informed leadership and strategic planning.

The design of workflows also necessitates an understanding of exception handling. Business processes rarely operate in a vacuum, and deviations from standard procedures are inevitable. Consultants must configure workflows to accommodate such variances, including error notifications, escalation paths, and conditional routing. By anticipating irregularities, the system maintains continuity and ensures that operational integrity is preserved even when unforeseen circumstances arise. This proactive approach to workflow management strengthens organizational resilience and reduces the likelihood of operational disruption.

Consultants must engage in continuous dialogue with business users to ensure that automated workflows remain relevant as organizational processes evolve. Companies often experience changes in policy, market conditions, or regulatory requirements that necessitate adjustments in workflow configurations. Dynamics 365 provides a flexible framework that allows consultants to modify workflows without extensive system downtime, enabling businesses to adapt with agility while maintaining the consistency and reliability of their operational processes.

A distinguishing feature of Dynamics 365 Finance and Operations is its capacity to integrate financial management with other critical business functions. Sales, procurement, production, inventory, and human resources converge within a cohesive environment, providing a panoramic view of enterprise operations. This integration is more than a technical convenience; it is a strategic enabler that allows managers to identify interdependencies, forecast demand, and allocate resources effectively.

The integration of financial and operational data allows for real-time visibility into cash flow, procurement cycles, and production capacity. Consultants play a vital role in configuring these integrated processes to ensure that data flows accurately across departments. For instance, procurement requests can be automatically linked to budgetary constraints, inventory availability, and supplier performance metrics, creating a seamless decision-making pipeline that reduces delays and mitigates risk.

Moreover, the platform’s analytics capabilities are amplified through integration. By consolidating data from multiple functions, organizations can perform sophisticated analyses such as variance tracking, profitability assessments, and trend forecasting. Consultants enable businesses to exploit these capabilities by configuring dashboards, reports, and alerts tailored to the unique requirements of different departments. As a result, stakeholders receive actionable intelligence in real-time, empowering them to make decisions grounded in comprehensive, accurate, and up-to-date information.

Integration also fosters compliance and accountability. By unifying data across modules, the platform ensures that all transactions adhere to internal controls and regulatory standards. Automated audit trails, approvals, and reporting mechanisms provide transparency and traceability, reducing the risk of fraud or mismanagement. Consultants are responsible for configuring these compliance features in alignment with both organizational policies and external regulations, creating a secure and trustworthy operational environment.

Dynamics 365 Finance and Operations is not merely a transactional tool; it is a lever for strategic transformation. Consultants are entrusted with the responsibility of aligning the platform’s capabilities with the organization’s long-term goals. This involves a dual focus: ensuring operational efficiency through meticulous configuration of workflows and modules, while simultaneously facilitating strategic insights through integrated analytics and reporting.

Consultants often conduct in-depth analyses of existing processes, identifying areas where technology can drive improvement. For example, repetitive tasks such as invoice approvals, purchase order management, or intercompany reconciliations can be automated to reduce processing time and improve accuracy. Beyond operational gains, this automation generates rich datasets that enable predictive analytics, scenario planning, and performance benchmarking. Organizations can then allocate resources more effectively, optimize supply chains, and anticipate market fluctuations with greater certainty.

Engagement with stakeholders is critical to this strategic orientation. Consultants must understand organizational priorities, pain points, and aspirations to tailor the system to produce meaningful results. This requires a rare combination of technical mastery, analytical reasoning, and interpersonal skill. By bridging the gap between technology and business strategy, consultants ensure that Dynamics 365 Finance and Operations is not only functional but also transformative, fostering a culture of continuous improvement and proactive decision-making.

Furthermore, the consultant’s remit extends to continuous evaluation of system performance. Business environments are dynamic, and processes that were optimal at implementation may require recalibration over time. Consultants must monitor operational metrics, solicit user feedback, and adapt workflows to evolving circumstances. This iterative approach maintains the system’s relevance and ensures sustained value over time.

The profound impact of workflow automation in Dynamics 365 extends beyond efficiency gains. By relieving employees from repetitive tasks, automation liberates cognitive bandwidth, allowing personnel to focus on higher-order activities such as problem-solving, strategic planning, and innovation. Organizations that exploit this capacity can accelerate product development, optimize supply chains, and improve customer engagement. Consultants guide businesses in identifying where automation can serve as a catalyst for innovation, rather than merely a cost-cutting mechanism.

Moreover, automation ensures that operational knowledge is codified within the system. Standardized workflows capture best practices and institutional knowledge, providing a repository that is accessible across departments and locations. This reduces dependency on individual expertise, enhances consistency, and supports training of new employees. Consultants play a pivotal role in designing these workflows to balance flexibility with control, ensuring that business processes remain adaptive while adhering to organizational standards.

In conclusion, Microsoft Dynamics 365 Finance and Operations is a sophisticated platform that transcends conventional ERP functions. Its ability to integrate diverse business processes, automate complex workflows, and provide real-time analytical insights positions it as a transformative tool for organizations seeking operational excellence and strategic agility. Consultants operating within this environment serve as architects, strategists, and analysts, ensuring that the platform is configured, implemented, and continuously optimized to meet both current operational needs and future growth imperatives. Mastery of workflow automation, integration, and strategic alignment is essential for translating the technical capabilities of Dynamics 365 into tangible business value and sustained competitive advantage.

Ensuring Robust Security and Access Control

In any enterprise resource planning environment, the security of financial and operational data is of paramount importance. Microsoft Dynamics 365 Finance and Operations provides a sophisticated framework for controlling access through a combination of roles, duties, and privileges. Each user’s access is meticulously defined based on their organizational responsibilities, ensuring that sensitive information is available only to those who require it. This level of granularity allows businesses to safeguard critical financial data while maintaining operational efficiency.

Consultants play an essential role in configuring security. Understanding the organization’s hierarchical structure and functional responsibilities is the first step in mapping roles appropriately. For example, a finance manager may need comprehensive access to reports, approvals, and reconciliations, whereas junior staff might only require rights to create and submit invoices. Duties further define the specific tasks that users are authorized to execute, and privileges specify the level of control within each task. This layered structure ensures that security is both robust and flexible, capable of adapting to changing business requirements.

The configuration of security is not static. As companies evolve, their operational needs shift, new employees are onboarded, and regulations change, requiring constant reevaluation of access controls. Consultants must continuously monitor these changes, ensuring that permissions remain aligned with organizational goals and compliance requirements. By doing so, they prevent unauthorized access, reduce the risk of data breaches, and maintain the integrity of financial information.

An additional benefit of meticulous security configuration is the facilitation of audit and compliance processes. Every transaction, approval, and modification can be traced to the responsible individual, creating an auditable trail that supports regulatory adherence. Consultants ensure that these audit trails are configured correctly, making certain that both internal and external audits can be conducted efficiently and with complete transparency.

Transitioning from legacy systems to Dynamics 365 Finance and Operations involves careful planning and execution to preserve data integrity. Data migration is a multifaceted endeavor that requires consultants to identify relevant data entities, cleanse and standardize information, and perform rigorous validation. Every piece of data, from historical financial transactions to customer records and inventory details, must be accurately transferred to ensure operational continuity.

The initial step in migration involves a detailed inventory of existing data. Consultants analyze the structure and format of the legacy data, determining how it maps to the corresponding entities within Dynamics 365. This process often uncovers inconsistencies, duplicates, or incomplete records that must be rectified before migration. Proper preparation minimizes the risk of errors and prevents disruption to ongoing business activities.

Test migrations are conducted to validate the accuracy and completeness of the transferred data. These trial runs enable consultants to identify discrepancies, adjust mappings, and refine processes before executing the final migration. During this stage, every transaction is reviewed to ensure that financial records, customer accounts, and operational data are correctly aligned with the new system’s architecture. The emphasis on validation guarantees that the migrated data is reliable and ready for real-time operational use.

Maintaining data integrity throughout the migration process is critical. Consultants implement checks to verify that data is consistent across modules and that relationships between entities, such as customer accounts and corresponding invoices, are preserved. Any errors or misalignments can have cascading effects on financial reporting, operational workflows, and decision-making processes. By meticulously managing these details, consultants ensure a smooth transition that preserves both historical accuracy and operational functionality.

After migration, consultants facilitate user training and system familiarization. Employees must understand how to access and utilize the migrated data effectively within the new platform. By providing comprehensive guidance and support, consultants ensure that the organization can maintain productivity and confidence in the accuracy of its financial and operational records.

Beyond the mechanics of migration, consultants must focus on the strategic configuration of the system to prevent future inconsistencies. This involves setting up validation rules, automated checks, and exception handling protocols. For instance, automated validation can flag duplicate invoices, missing account allocations, or discrepancies in financial postings, enabling immediate resolution. These safeguards maintain the accuracy and reliability of data as the organization continues to operate within the platform.

Additionally, consultants configure integration points with other systems, such as customer relationship management or inventory management tools. Seamless integration ensures that data flows smoothly between modules, reducing the need for manual entry and minimizing the risk of errors. By maintaining alignment between interconnected systems, organizations can achieve a unified operational environment where all functions are informed by consistent and accurate data.

The strategic approach also includes defining data governance policies. Consultants work with leadership to establish protocols for data entry, modification, and archival. Clear guidelines prevent inconsistencies, maintain historical accuracy, and ensure that financial reports remain reliable for strategic planning and compliance purposes. Through careful configuration and governance, the organization achieves both operational efficiency and regulatory readiness.

Automation plays a crucial role in streamlining data handling and operational workflows. By automating routine financial and operational processes, organizations reduce manual effort, minimize human error, and free resources for analytical and strategic tasks. For example, recurring invoice generation, approval routing, and payment processing can be automated to ensure timeliness and accuracy. This automation not only improves operational efficiency but also creates a repository of structured, traceable transactions that can support advanced reporting and predictive analysis.

Consultants must evaluate business processes to determine which tasks are most suitable for automation. By identifying repetitive, high-volume activities, they design automated workflows that maintain control and visibility while improving speed and reliability. Exception handling is incorporated to manage deviations, ensuring that the system remains flexible and capable of handling unforeseen scenarios without compromising data integrity.

Furthermore, automation enhances accountability. Every automated action is recorded, providing a transparent trail for review and audit purposes. Organizations can track approvals, validate transaction accuracy, and ensure compliance with internal and external requirements. Consultants ensure that these mechanisms are configured effectively, providing a balance between operational efficiency and control.

In addition to operational efficiency, security configuration, data migration, and automation serve as critical instruments for risk mitigation. The financial and operational data within Dynamics 365 Finance and Operations are sensitive and require stringent controls to prevent fraud, errors, or regulatory breaches. Consultants design systems that not only protect against unauthorized access but also detect anomalies and irregularities. Automated alerts can notify management of unusual activity, ensuring that potential issues are addressed promptly.

Compliance is another dimension where meticulous configuration proves invaluable. Organizations must adhere to industry standards, local regulations, and international reporting requirements. By configuring security roles, audit trails, and validation rules, consultants help ensure that every transaction is documented accurately and that reporting obligations are met. This proactive approach reduces the likelihood of penalties, reputational damage, or operational disruption due to non-compliance.

Moreover, continuous monitoring and reassessment of security and access controls enable organizations to remain agile in response to changing regulations and internal policies. Consultants advise on periodic reviews, access adjustments, and policy updates, ensuring that the system evolves in tandem with organizational and regulatory shifts. This vigilance transforms the platform into a resilient operational backbone capable of sustaining both growth and compliance.

A well-secured system does not impede efficiency; rather, it enhances it. By thoughtfully configuring access controls, consultants ensure that employees have the permissions necessary to perform their duties without unnecessary restrictions. This balance between security and usability prevents bottlenecks, reduces delays, and fosters a culture of accountability. Employees can trust that the system supports their responsibilities while safeguarding sensitive information.

The integration of security with operational workflows also contributes to strategic visibility. With properly configured roles and access controls, management can monitor process execution, detect inefficiencies, and ensure that critical financial and operational data is handled correctly. Consultants optimize these configurations so that security measures support, rather than obstruct, organizational objectives.

Effective financial management is the cornerstone of operational efficiency and strategic decision-making in any organization. Microsoft Dynamics 365 Finance provides an extensive suite of tools that allows consultants to configure and optimize financial operations. Account structures are foundational, defining how transactions are categorized, recorded, and reported across the organization. Consultants ensure that every ledger, journal, and account code is meticulously mapped to maintain consistency and accuracy in financial reporting.

Financial dimensions are another critical element in the platform, enabling the tracking of costs, revenues, and operational metrics across departments, projects, or regions. By leveraging dimensions, businesses can gain a granular view of their financial landscape, allowing for detailed analysis, accurate forecasting, and informed decision-making. Consultants customize these dimensions to align with the unique operational requirements of each organization, ensuring that data collection and reporting meet both managerial and regulatory needs.

Posting definitions determine how transactions are recorded, whether as credits or debits, and they encompass various transaction types including purchases, sales, internal transfers, and adjustments. Proper configuration ensures that every financial entry is accurately captured and reflected in the system, reducing discrepancies and improving reliability. Cost accounting complements this by enabling organizations to track production costs, allocate expenses to business segments, and assess the profitability of products, services, or projects. Through cost accounting, consultants help management make strategic decisions based on real-time operational and financial insights.

Accounts payable and receivable processes are vital for maintaining liquidity and operational stability. Consultants configure customer and vendor posting profiles to ensure accurate recording of financial transactions. Each profile defines how invoices, payments, and adjustments are processed, providing a framework that aligns with the organization’s policies and operational workflows. Billing codes are configured to handle taxes, discounts, and service charges, enabling precise invoicing and streamlined collections.

Automation plays a key role in improving efficiency within AP and AR processes. Recurring payments, subscription billing, and automated collections reduce manual effort and ensure timely financial transactions. Consultants also configure payment methods, including electronic transfers and checks, to facilitate prompt vendor settlements and maintain positive supplier relationships. Accurate management of these processes ensures cash flow stability, minimizes late payments, and strengthens overall financial control.

Recurring collections and automated reminders assist organizations in managing overdue accounts effectively. By configuring these systems within Dynamics 365, consultants help businesses reduce the risk of bad debt while maintaining strong customer relationships. These configurations not only optimize cash flow but also provide transparency and traceability for audits and financial reporting.

Budgeting is a strategic function that enables organizations to align expenditures with corporate objectives. Dynamics 365 Finance provides tools for setting up budget plans, defining controls, and tracking performance against targets. Consultants work with stakeholders to configure budgets that reflect expected revenues and expenses, aligning financial planning with operational and strategic goals.

Budget controls are essential for enforcing spending limits. Alerts can be triggered when departments exceed allocations, and further transactions may be restricted until adjustments are approved. This level of oversight ensures that organizations remain within financial targets and prevents overspending. Consultants also configure budget revisions, allowing organizations to adapt to changing conditions such as market fluctuations, unexpected expenses, or new revenue streams.

Real-time monitoring of budget performance enables management to respond quickly to variances. Analytics and reporting tools within Dynamics 365 provide insights into how financial resources are utilized, highlighting areas of over-expenditure or under-utilization. Consultants ensure that these tools are configured to deliver actionable information, supporting timely and informed decision-making. Effective budgeting also enhances resource allocation, allowing businesses to prioritize initiatives that drive growth while maintaining fiscal discipline.

Managing periodic financial processes is crucial for ensuring accuracy, compliance, and consistency. Financial calendars define the periods for accounting activities, including fiscal year definitions and reporting intervals. Consultants configure these calendars to align with organizational policies and ensure that all transactions are posted to the correct periods.

Period-end and year-end closings require meticulous attention to detail. Consultants oversee the finalization of journals, accruals, and adjustments to ensure that financial statements accurately reflect organizational performance. Locking periods prevents further changes after closure, preserving the integrity of the records. Accrual schemes are configured to recognize revenue and expenses for future periods, maintaining accurate reporting and avoiding distortions in financial statements.

Cash flow management is integrated into these processes to ensure liquidity and operational stability. Consultants establish systems to monitor inflows and outflows, reconcile accounts, and provide insights into financial health. This proactive approach enables management to anticipate challenges, optimize working capital, and make strategic investments with confidence.

Handling diverse accounting entries, including intercompany transactions, adjustments, and currency translations, is an essential responsibility. Consultants configure the system to process these entries correctly, ensuring compliance with accounting standards and facilitating accurate reporting across multiple legal entities. These configurations are critical for multinational organizations, where different currencies, tax regulations, and reporting requirements must be harmonized.

Organizations operating across multiple regions or business units often require consolidated financial reporting. Dynamics 365 Finance allows consultants to integrate data from various entities, manage intercompany transactions, and eliminate duplications for accurate reporting. Each entity may have distinct accounting methods, currencies, or reporting structures, necessitating careful mapping and configuration.

Intercompany accounting is a critical aspect of consolidation. Transactions between entities must be tracked and eliminated appropriately to prevent double-counting. Consultants ensure that these processes are configured to maintain the integrity of the consolidated financial statements, providing a clear and accurate view of overall organizational performance.

Currency translation is another complexity in consolidation. Consultants configure exchange rates and translation rules to convert financial data into the reporting currency, accounting for fluctuations and ensuring consistency. Accurate financial consolidation allows management to assess organizational performance holistically, make strategic decisions, and comply with regulatory reporting requirements across jurisdictions.

Tax configuration within Dynamics 365 Finance is vital for compliance and accurate reporting. Consultants establish tax codes, rates, and exemptions to ensure that transactions are processed correctly in accordance with local and international regulations. Foreign currency revaluation is managed to account for exchange rate fluctuations, ensuring that cross-border transactions reflect the correct tax obligations.

Tax filing processes are configured to generate reports that meet the requirements of tax authorities, including deadlines, format specifications, and reporting criteria. Consultants also address special tax scenarios such as deductions, exemptions, or deferred tax treatments, ensuring that the organization remains compliant while optimizing tax obligations. Accurate tax configuration reduces the risk of penalties, improves transparency, and enhances financial governance.

Financial dimensions provide a mechanism to categorize transactions across various attributes, enabling detailed analysis and reporting. Consultants configure these dimensions to reflect organizational needs, such as tracking costs by department, project, or region. This granular visibility supports strategic decision-making, allowing management to identify trends, assess profitability, and optimize resource allocation.

Project-based organizations benefit significantly from financial dimensions, as costs and revenues can be tracked per project. Consultants ensure that the system captures project-specific financial activity accurately, providing insights into performance, resource utilization, and return on investment. Reporting tools leverage these dimensions to present multidimensional views of organizational finances, facilitating comprehensive analysis and forecasting.

Financial dimensions also support compliance and audit readiness. Each transaction can be traced to the responsible department, cost center, or project, providing a clear audit trail. Consultants configure reporting structures to ensure that regulatory requirements are met while providing management with actionable insights into organizational performance.

Financial configuration, budgeting, and periodic processes are interconnected elements that define the operational and strategic health of an organization. Consultants continuously assess system performance, identify inefficiencies, and propose enhancements to maximize the value of Dynamics 365 Finance. Automation of recurring tasks, streamlined reporting, and real-time analytics enable organizations to operate with greater agility and precision.

By integrating financial management with budgeting and consolidation processes, consultants help organizations achieve operational coherence, fiscal discipline, and strategic foresight. Each configuration decision—from account structures to intercompany eliminations, from accruals to tax codes—is made with a holistic understanding of the organization’s objectives. This ensures that the system not only supports day-to-day operations but also provides insights that drive growth and innovation.

Consultants also emphasize training and change management, ensuring that end-users understand the system’s functionalities and can leverage its capabilities effectively. By empowering users with knowledge and providing ongoing support, organizations can maintain high levels of accuracy, compliance, and productivity.

Ensuring Effective Solution Validation

Implementing Microsoft Dynamics 365 Finance successfully requires rigorous validation to ensure that the system aligns with organizational objectives and operates seamlessly within existing processes. Solution validation is a comprehensive process that evaluates functionality, performance, security, and integration capabilities. Consultants play a pivotal role by verifying that the platform delivers expected outcomes while providing a robust framework for operational efficiency and strategic decision-making.

Solution validation begins with understanding the business requirements in depth. Consultants engage with stakeholders to map workflows, identify critical processes, and capture the nuances of organizational operations. This ensures that the system configuration reflects real-world needs and supports core business objectives. By simulating operational scenarios, consultants test the accuracy of financial postings, workflow automation, reporting mechanisms, and interdepartmental transactions. This meticulous approach helps detect potential discrepancies before the system goes live, preventing costly operational interruptions and data inconsistencies.

Functional testing is complemented by performance assessments, where the system’s behavior under varying loads is evaluated. Consultants simulate peak transaction volumes to confirm that Dynamics 365 Finance can handle complex processes without delays or errors. Stress testing and performance monitoring also reveal bottlenecks or configuration weaknesses that could hinder efficiency, allowing consultants to implement corrective measures proactively.

Security validation is another critical component. Consultants examine roles, duties, and privileges to ensure that sensitive financial data is accessible only to authorized personnel. By simulating potential unauthorized access attempts and verifying compliance with regulatory standards, they establish a secure operational environment. Validation extends to integrations with other enterprise systems, such as customer relationship management, procurement, and payroll solutions, confirming that data flows accurately and consistently across the organizational ecosystem.

Application Lifecycle Management is integral to the continuous success of Dynamics 365 Finance. Lifecycle management tools, including cloud-based platforms, facilitate monitoring, diagnostics, deployment, and maintenance throughout the system’s lifespan. Consultants utilize these tools to oversee updates, manage configurations, and maintain optimal performance across all organizational functions.

Lifecycle management begins with deployment oversight, ensuring that configurations are implemented accurately and that the system is fully operational from the outset. Consultants track system health metrics, monitor transaction processing, and identify early signs of performance degradation or functional misalignment. By employing predictive diagnostics, potential issues can be addressed before they escalate, minimizing disruption and enhancing system reliability.

Ongoing maintenance is another critical aspect. Dynamics 365 Finance evolves continuously through software updates and feature enhancements. Consultants use lifecycle management tools to deploy updates efficiently, ensuring that organizations benefit from the latest innovations without compromising stability or operational continuity. Updates may include new reporting capabilities, regulatory compliance adjustments, or workflow enhancements that optimize financial management and operational efficiency.

Issue tracking and resolution form an essential component of lifecycle management. Consultants document anomalies, prioritize resolutions, and implement corrective actions systematically. This structured approach ensures that problems are addressed promptly, preserving data integrity, operational continuity, and user satisfaction. Continuous monitoring allows organizations to maintain high standards of reliability and performance, ensuring that the system remains aligned with strategic goals.

Collaboration facilitated by lifecycle management tools is essential for maintaining coherence between business analysts, developers, functional consultants, and end-users. Shared platforms enable transparent communication, real-time updates, and coordinated problem-solving. By fostering collaboration, consultants ensure that the system evolves in harmony with organizational needs, supporting seamless operations and strategic decision-making.

User acceptance testing is a crucial step in ensuring that Dynamics 365 Finance is ready for production. UAT engages end-users directly, providing an opportunity to validate that the system meets functional requirements, supports daily operations, and delivers expected outcomes. Consultants facilitate UAT by guiding users through test scenarios, observing interactions, and documenting feedback.

Test scripts are developed to reflect actual business workflows, covering financial postings, workflow automation, reporting, and compliance processes. Users execute these scenarios under controlled conditions, simulating real operational tasks. Consultants monitor results, identify discrepancies, and implement adjustments to ensure that the system functions reliably in production. This iterative approach strengthens user confidence and ensures smooth adoption.

UAT also evaluates usability, ensuring that the system interface is intuitive and that end-users can perform their responsibilities efficiently. Feedback on navigation, workflow visibility, and reporting accessibility informs refinements to system design and configuration. By addressing user concerns proactively, consultants enhance operational efficiency and reduce the risk of errors post-deployment.

Successful UAT confirms that Dynamics 365 Finance is fully operational, accurately configured, and aligned with organizational objectives. It serves as the final validation step before go-live, ensuring that the system is prepared to handle complex transactions, maintain compliance, and support decision-making across departments.

Continuous improvement is essential for ensuring that Dynamics 365 Finance remains aligned with evolving business needs. Gap analysis is the systematic identification of discrepancies between system capabilities and organizational requirements. Consultants use gap analysis to detect areas for enhancement, optimize workflows, and implement strategic adjustments that maximize system value.

Gap analysis involves reviewing operational processes, financial reporting, automation efficacy, and user feedback. Consultants compare expected outcomes with actual system performance, identifying bottlenecks, inefficiencies, or functionality gaps. This process allows organizations to refine configurations, enhance reporting structures, and improve workflow automation, ensuring that the platform continues to support business objectives effectively.

As organizations expand, new operational challenges emerge, necessitating adaptations in system configurations. Consultants anticipate these changes and proactively implement solutions, such as adjusting financial dimensions, refining account structures, or updating workflow rules. Continuous gap analysis ensures that Dynamics 365 Finance evolves in parallel with organizational growth, maintaining scalability, accuracy, and strategic relevance.

Strategic enhancements informed by gap analysis extend beyond technical adjustments. Consultants evaluate how the system supports decision-making, resource allocation, and compliance. By addressing gaps in reporting accuracy, workflow efficiency, or data visibility, they enhance organizational agility and enable management to respond effectively to market dynamics and operational challenges.

The role of a Dynamics 365 Finance consultant transcends configuration and deployment. Continuous engagement ensures that the system remains a strategic asset, delivering insights, efficiency, and compliance across financial operations. Consultants collaborate with business units to monitor evolving needs, implement updates, and optimize configurations, transforming the platform into a proactive enabler of organizational performance.

Continuous engagement includes reviewing automated workflows, analyzing reporting structures, and monitoring system performance metrics. Consultants provide recommendations for improvements, leveraging advanced functionalities to streamline processes, reduce operational friction, and enhance financial visibility. This ongoing refinement ensures that the platform adapts to shifting priorities and maximizes return on investment.

Training and knowledge transfer are integral to sustained success. Consultants empower end-users with expertise in system functionalities, reporting capabilities, and process automation. By fostering a culture of competence and confidence, organizations can maintain operational continuity, reduce errors, and enhance overall productivity. This human-centric approach complements technical optimizations, creating a resilient and adaptable operational environment.

Lifecycle management, solution validation, UAT, and gap analysis collectively form a framework for continuous system enhancement. Each component contributes to a cohesive strategy that ensures Dynamics 365 Finance remains aligned with business goals, regulatory requirements, and operational realities. Consultants orchestrate these elements, enabling organizations to achieve sustained efficiency, transparency, and growth.

Advanced analytics and reporting within Dynamics 365 Finance provide critical insights that inform strategic decisions. Consultants configure the system to capture data across financial transactions, operational workflows, and organizational units. This data is synthesized into comprehensive reports, dashboards, and predictive analyses that guide resource allocation, risk management, and growth strategies.

Financial reporting encompasses multi-dimensional analysis using financial dimensions, account structures, and project-based tracking. Consultants ensure that reports present an accurate and actionable representation of organizational performance. Analytics support trend identification, variance analysis, and scenario planning, allowing management to anticipate challenges, evaluate opportunities, and optimize strategic initiatives.

Predictive analytics further enhance decision-making by modeling potential outcomes based on historical data and operational patterns. Consultants configure the system to provide insights into cash flow projections, budget adherence, and profitability trends. These insights enable proactive management, mitigating risks and capitalizing on emerging opportunities.

Maintaining regulatory compliance and operational integrity is an ongoing priority for organizations using Dynamics 365 Finance. Consultants establish robust controls, monitor adherence to internal policies, and ensure alignment with external regulations. This includes accurate tax reporting, intercompany reconciliation, and adherence to accounting standards across multiple entities and jurisdictions.

Continuous monitoring of system performance, security settings, and workflow compliance enables early detection of potential issues. Consultants implement corrective measures, refine configurations, and provide guidance to maintain operational consistency. This proactive approach minimizes the risk of financial errors, regulatory penalties, and operational disruptions.

Microsoft Dynamics 365 Finance and Operations serves as a robust platform that integrates financial management, operational workflows, and strategic business processes into a unified environment, enabling organizations to achieve efficiency, accuracy, and agility. The successful implementation and optimization of this system rely on a holistic approach where consultants play a central role, guiding organizations through configuration, workflow automation, security management, data migration, and continuous improvement. By understanding the intricacies of financial management, including account structures, financial dimensions, cost accounting, accounts payable and receivable, budgeting, consolidation, and tax management, consultants ensure that organizations can maintain precise financial records, streamline operations, and make informed decisions.

Workflow automation and process optimization reduce repetitive tasks, minimize errors, and accelerate operational efficiency, while robust security configurations safeguard sensitive financial data and maintain compliance with internal policies and regulatory requirements. Data migration is executed meticulously to preserve historical accuracy, ensuring seamless transitions from legacy systems to Dynamics 365 without operational disruption. Consultants further enhance the platform’s value by analyzing business processes, identifying gaps, and implementing tailored solutions that improve efficiency, resource allocation, and strategic decision-making.

Solution validation, application lifecycle management, and user acceptance testing establish the reliability, performance, and readiness of the system, confirming that it aligns with business objectives and supports user needs effectively. Continuous gap analysis and proactive system optimization allow the platform to evolve with organizational growth, adapting to new requirements, market conditions, and operational challenges. Advanced analytics and reporting capabilities provide deep insights into financial performance, enabling predictive planning, informed decision-making, and agile responses to emerging opportunities and risks.

Through continuous engagement, knowledge transfer, and strategic oversight, consultants ensure that Dynamics 365 Finance becomes not only a transactional system but a strategic enabler, empowering organizations to maintain operational integrity, regulatory compliance, and financial transparency. By leveraging the full capabilities of the platform, businesses can enhance productivity, optimize workflows, strengthen decision-making, and achieve sustainable growth in dynamic and competitive markets. The integration of technical expertise, strategic insight, and continuous improvement ensures that organizations extract enduring value from Dynamics 365 Finance, positioning it as a critical tool for long-term success, innovation, and organizational excellence.

Study with ExamSnap to prepare for Microsoft Certified: Dynamics 365 Supply Chain Management Functional Consultant Associate Practice Test Questions and Answers, Study Guide, and a comprehensive Video Training Course. Powered by the popular VCE format, Microsoft Certified: Dynamics 365 Supply Chain Management Functional Consultant Associate Certification Exam Dumps compiled by the industry experts to make sure that you get verified answers. Our Product team ensures that our exams provide Microsoft Certified: Dynamics 365 Supply Chain Management Functional Consultant Associate Practice Test Questions & Exam Dumps that are up-to-date.

Microsoft Training Courses

SPECIAL OFFER: GET 10% OFF

This is ONE TIME OFFER

A confirmation link will be sent to this email address to verify your login. *We value your privacy. We will not rent or sell your email address.

Download Free Demo of VCE Exam Simulator

Experience Avanset VCE Exam Simulator for yourself.

Simply submit your e-mail address below to get started with our interactive software demo of your free trial.